Okay, prepare yourself for the fantastic joy of bidding for a hotel on Priceline. Also, take your heart medication beforehand, because that moment while you're waiting to find out if your bid has been accepted and what hotel you've gotten can be as good as running a marathon. And let's go.

Here's a little guided tour through the whole process. Let's pretend you are going to go to Chicago for 3 nights over Memorial Day.

First, you'd go Bidding for Travel.

Scroll down until you find the state your destination city is in and click the link:

Once you're into your city, choose the hotel list:

And you'll get a list of all the hotels (by zone and then star level) that Bidding for Travel has had people win Priceline bids for in that city, with links to the hotels websites and what zones they are in:

At the top of this page, there is a long warning, which I'll repeat here. This list is not going to be hundred percent accurate! Priceline can change the star-rating for a hotel or there may be hotels that are not on the list because no one has ever posted that they've won a bid there or the zones may change unexpectedly, etc. This is just to give you a reasonably good idea of what kind of hotels you have a shot at getting in any particular zone or star level. I usually click around and look at the hotels so I know which zones or star levels I'll be unhappy with and thus which ones to avoid.

Once you have a feel for the hotels in the area, I usually go back to the main list for the city and see what people have been paying for hotels:

The one I've circled is for Memorial Day weekend. If you click the link, you'll notice that the rate on the hotel's website for those same dates is $409 per night, so $99 is a steal. This also lets you know that if you're willing to go less than a 4 star, you shouldn't have too much trouble doing it for well under $100 per night.

Now, it's time to actually go to Priceline and go to the Name Your Own Price section for hotels (but go through Ebates so you can get your 2% back):

In the screen that pops up, fill in your information:

and press "Bid Now."

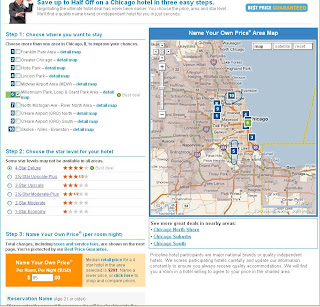

And now the real fun starts:

Here's the main bidding screen. First you need to select which areas of the city you're willing to stay in. Start with one (so that you have things to add later if your first bid doesn't get accepted).

Lets say you want to stay downtown. And you only want a 3 1/2 star or nicer hotel.

Select "Millennium Park" as your area, choose "4-Star Deluxe "for your star level, and put in how much you're willing to pay per night.

You also need to put in the name of the person the reservation will be in. And then you push "Next."

You'll get a screen that lets you review your bid:

Make sure your dates are right and check out the total price, then initial and go to the next screen, where you'll put in your credit card number. Once that's done, they'll look for a hotel room for you.

If you get a room, hooray! Success. Brag to everyone you know about what a great deal you got.

If not, it'll give you an opportunity to rebid, but you'll have to change something besides your price. You can wait 24 hours and start over. OR. . . you can add zones and star levels.

In this case, you could add 3 1/2 stars as a level you'd be willing to stay at and try again with a slightly higher price.

If it still doesn't work, add the North Michigan Avenue area and bid again (or you could do these in the opposite order and try adding a zone before you lower your star level).

And then, if you are still unsuccessful, you can start adding zones that don't have your star level, which basically is a free re-bid (meaning, you don't have to lower your standards or wait 24 hours).

If you click through the zones, you'll notice some zones only have really low-star hotels available, like Franklin Park which only goes up to a whopping 2 stars.

This means that if you add that zone to your bid but keep your star level at 3 1/2 stars or higher, you have no chance of getting something in the Franklin Park area because they don't HAVE any hotels that are 3 1/2 stars or higher. The Hyde Park zone also does not go above 2 stars, so it'd be another free rebid.

Eventually, you'll get a hotel room. And you'll rejoice, especially when you look at how much money you're saving.

Easy enough, right? Questions?

Apr 30, 2010

Apr 29, 2010

Saving in the Produce Aisle (Carole)

As The Coupon Mom says, "I don't know when we all got too busy to wash lettuce."

I don't think anyone reading this blog can be so young that you cannot remember the days before pre-packaged salad greens took over the lettuce section. If you are this young, take my word for it, those days did exist. And they weren't that bad. I admit that I, on occasion, do buy a Caesar's Salad Kit. But for the most part I prefer to buy my own head of lettuce, saute up some homemade croutons, sprinkle some parmesan cheese and add a dollop or two of caesar's dressing. Amazingly, it's not that much more work. Maybe 10 extra minutes.

A salad kit at my store costs about $3.50 cents. It serves 3 people and turns all slimy and disgusting immediately after the meal. Even if I haven't mixed all of the greens into the salad, those bagged extra lettuce leaves are history before morning. Have you noticed this too? I'm not sure what special chemical they put inside that sealed plastic bag to keep the lettuce fresh, but as soon as it's opened, forget it. The magic is over.

On the other hand, an entire head of romaine lettuce (unwashed and uncut) costs less than $2.00. This one head, if properly washed, dried and stored in the fridge (taking less than 5 minutes) will last -- all fresh and crispy -- for nearly 2 weeks. And it will make a HUGE caesar's salad that would feed a family of 10! The croutons are almost free since I use stale bread that otherwise would be thrown out, and the cheese and dressing are bought on sale for a couple of dollars. The entire super-duper, large salad costs about $4. If, however, I make a salad the same size as the kit, the cost is about $1.

This kind of vegetable mark-up is becoming very common. The Coupon Mom says in her great book, The Coupon Mom's Guide to Cutting Your Grocery Bills in Half, that she "saved $6.32 by washing [her] lettuce instead of buying the equivalent amount . . . of washed romaine. Some quick calculations show that works out to a "salary" of $76 per hour, or $3,040 per week, or more than $158,000 per year." (pg 140) That's a lot of money to have someone else wash your lettuce!

These kinds of savings are true of all pre-prepared fruits and vegetables like apple slices, cut-up melon, celery sticks, pre-cut strawberries and those cute little peeled baby carrots versus the regular pulled-right-out-of-the-ground carrots. Do we even remember what those old fashioned kind of carrots look like?? (Have you kids ever seen one?) If you've forgotten, you might want to watch an old Bugs Bunny cartoon to refresh your memory!

I don't think anyone reading this blog can be so young that you cannot remember the days before pre-packaged salad greens took over the lettuce section. If you are this young, take my word for it, those days did exist. And they weren't that bad. I admit that I, on occasion, do buy a Caesar's Salad Kit. But for the most part I prefer to buy my own head of lettuce, saute up some homemade croutons, sprinkle some parmesan cheese and add a dollop or two of caesar's dressing. Amazingly, it's not that much more work. Maybe 10 extra minutes.

A salad kit at my store costs about $3.50 cents. It serves 3 people and turns all slimy and disgusting immediately after the meal. Even if I haven't mixed all of the greens into the salad, those bagged extra lettuce leaves are history before morning. Have you noticed this too? I'm not sure what special chemical they put inside that sealed plastic bag to keep the lettuce fresh, but as soon as it's opened, forget it. The magic is over.

On the other hand, an entire head of romaine lettuce (unwashed and uncut) costs less than $2.00. This one head, if properly washed, dried and stored in the fridge (taking less than 5 minutes) will last -- all fresh and crispy -- for nearly 2 weeks. And it will make a HUGE caesar's salad that would feed a family of 10! The croutons are almost free since I use stale bread that otherwise would be thrown out, and the cheese and dressing are bought on sale for a couple of dollars. The entire super-duper, large salad costs about $4. If, however, I make a salad the same size as the kit, the cost is about $1.

This kind of vegetable mark-up is becoming very common. The Coupon Mom says in her great book, The Coupon Mom's Guide to Cutting Your Grocery Bills in Half, that she "saved $6.32 by washing [her] lettuce instead of buying the equivalent amount . . . of washed romaine. Some quick calculations show that works out to a "salary" of $76 per hour, or $3,040 per week, or more than $158,000 per year." (pg 140) That's a lot of money to have someone else wash your lettuce!

These kinds of savings are true of all pre-prepared fruits and vegetables like apple slices, cut-up melon, celery sticks, pre-cut strawberries and those cute little peeled baby carrots versus the regular pulled-right-out-of-the-ground carrots. Do we even remember what those old fashioned kind of carrots look like?? (Have you kids ever seen one?) If you've forgotten, you might want to watch an old Bugs Bunny cartoon to refresh your memory!

Apr 28, 2010

Recipe Wednesday: Flavorful Italian Soup (Merrick)

Well folks, I'm back on the blogging bandwagon. Thank you for all your sweet comments about our little guy. We're all recovering very well, and actually getting quite a bit of sleep! We couldn't have asked for a better baby!

Along with the birth of our baby, we had many people bringing over meals, as well as my mom cooking for us while she was here for a week. So now that our stash of leftovers and frozen meals are depleting, I'm forced to start cooking again. For these next few weeks when I'm adjusting to being a full time mom and juggling everything that goes along with that role, I'm going to keep cooking pretty simple. Guaranteed to be included in those simple meals is one our favorites -- Flavorful Italian Soup.

Although there are quite a few ingredients, it's one of those recipes where you chop everything up and throw it in a pot all at once. So easy.

Flavorful Italian Soup

1/2 smoked sausage link, sliced ($1.50)

4 cups chicken broth ($0.16)

1 cup water

2 medium potatoes, cubed (peeled if desired) ($0.30)

1 cup chopped carrot ($0.30)

1/2 cup chopped onion ($0.10)

1/2 cup sliced mushrooms ($1.00)

1 teaspoon dried basil ($0.05)

1 teaspoon Italian seasoning ($0.05)

2 teaspoons Tabasco sauce ($0.05)

Dash garlic salt

1/3 package broken uncooked spaghetti (2-inch pieces) ($0.40)

In a large cooking pot, combine sausage, broth, water, vegetables, and seasoning. Bring to a boil. Reduce heat; cover and simmer for 30 minutes. Add spaghetti. Cover and simmer 8-10 minutes longer or until spaghetti and vegetables are tender. Serves 4.

Total Cost: $3.91. That's pretty hard to beat.

Along with the birth of our baby, we had many people bringing over meals, as well as my mom cooking for us while she was here for a week. So now that our stash of leftovers and frozen meals are depleting, I'm forced to start cooking again. For these next few weeks when I'm adjusting to being a full time mom and juggling everything that goes along with that role, I'm going to keep cooking pretty simple. Guaranteed to be included in those simple meals is one our favorites -- Flavorful Italian Soup.

Although there are quite a few ingredients, it's one of those recipes where you chop everything up and throw it in a pot all at once. So easy.

Flavorful Italian Soup

1/2 smoked sausage link, sliced ($1.50)

4 cups chicken broth ($0.16)

1 cup water

2 medium potatoes, cubed (peeled if desired) ($0.30)

1 cup chopped carrot ($0.30)

1/2 cup chopped onion ($0.10)

1/2 cup sliced mushrooms ($1.00)

1 teaspoon dried basil ($0.05)

1 teaspoon Italian seasoning ($0.05)

2 teaspoons Tabasco sauce ($0.05)

Dash garlic salt

1/3 package broken uncooked spaghetti (2-inch pieces) ($0.40)

In a large cooking pot, combine sausage, broth, water, vegetables, and seasoning. Bring to a boil. Reduce heat; cover and simmer for 30 minutes. Add spaghetti. Cover and simmer 8-10 minutes longer or until spaghetti and vegetables are tender. Serves 4.

Total Cost: $3.91. That's pretty hard to beat.

Apr 27, 2010

Saving on Hotels (Janssen)

If you read my personal blog, you'll know that my husband and I really love to travel. Of course, travel can get expensive, quickly, and so I'm always looking for ways to slash the cost wherever I can.

One of the best ways I've found to do this is through Priceline's "Name Your Own Price" feature for hotels. Hotel prices add up really fast, especially if you're traveling for more than a day or two, so saving fifty to a hundred dollars a night leaves you either with a smaller cost of traveling, or more money to spend actually doing things, rather than just having a place to dump your suitcase.

The basic idea is this: you select your city and then the areas of the city you're willing to stay in, the dates for your stay, a star-level of hotel, and the price you'll pay per night. Then you put in your credit card number and push okay to go ahead with your bid.

If your bid is accepted, your card is automatically charged before you ever see what hotel you're staying at. If it's not accepted, you can wait 24 hours and bid again, or change parts of your bid and try again immediately (changing the price you'll pay doesn't count - you have to add areas you'll stay in or change your star level or your dates).

I'll be the first to admit, I was a bit wary of this whole idea for a long time, because it just seemed so sketchy - you could end up with a really skeezy hotel and have no real options for getting out of it, since they charge you before you even SEE your hotel. Not my idea of a good time. But my extremely savings-savvy friend, Kristi, assured me she'd used it a bazillion times and always had good results, and I finally decided to trust her.

We've now used it a number of times and every time it's been a win. We've stayed in beautiful hotels, right in the middle of the city, in San Francisco, Boston, New York City, and Milwaukee. So no complaints from me.

You'll definitely want to use Bidding for Travel to help you use Priceline. It's a message board where people list how much they got their hotel rooms for and the site maintains a list of all the hotels they know of in specific cities that Priceline uses. Otherwise you might overbid or underbid because you have no idea what hotels in a certain city are going for (for example, when we went to Milwaukee, hotels were going for between $50-70 for a four-star hotel, while a similarly nice hotel in New York City was more like $150-200 per night).

And, of course, you can get to Priceline through Ebates (more info about Ebates here) and get 2% of your total cost back in cash. Which I never complain about (except when I forget to use Ebates and then I complain loudly to my long-suffering husband).

On Friday, I'll post step-by-step instructions (with screen shots!) about how to make a successful bid on Priceline.

One of the best ways I've found to do this is through Priceline's "Name Your Own Price" feature for hotels. Hotel prices add up really fast, especially if you're traveling for more than a day or two, so saving fifty to a hundred dollars a night leaves you either with a smaller cost of traveling, or more money to spend actually doing things, rather than just having a place to dump your suitcase.

The basic idea is this: you select your city and then the areas of the city you're willing to stay in, the dates for your stay, a star-level of hotel, and the price you'll pay per night. Then you put in your credit card number and push okay to go ahead with your bid.

If your bid is accepted, your card is automatically charged before you ever see what hotel you're staying at. If it's not accepted, you can wait 24 hours and bid again, or change parts of your bid and try again immediately (changing the price you'll pay doesn't count - you have to add areas you'll stay in or change your star level or your dates).

I'll be the first to admit, I was a bit wary of this whole idea for a long time, because it just seemed so sketchy - you could end up with a really skeezy hotel and have no real options for getting out of it, since they charge you before you even SEE your hotel. Not my idea of a good time. But my extremely savings-savvy friend, Kristi, assured me she'd used it a bazillion times and always had good results, and I finally decided to trust her.

We've now used it a number of times and every time it's been a win. We've stayed in beautiful hotels, right in the middle of the city, in San Francisco, Boston, New York City, and Milwaukee. So no complaints from me.

You'll definitely want to use Bidding for Travel to help you use Priceline. It's a message board where people list how much they got their hotel rooms for and the site maintains a list of all the hotels they know of in specific cities that Priceline uses. Otherwise you might overbid or underbid because you have no idea what hotels in a certain city are going for (for example, when we went to Milwaukee, hotels were going for between $50-70 for a four-star hotel, while a similarly nice hotel in New York City was more like $150-200 per night).

And, of course, you can get to Priceline through Ebates (more info about Ebates here) and get 2% of your total cost back in cash. Which I never complain about (except when I forget to use Ebates and then I complain loudly to my long-suffering husband).

On Friday, I'll post step-by-step instructions (with screen shots!) about how to make a successful bid on Priceline.

Apr 26, 2010

Saving for Both Short and Long Term Goals (Carole)

Melanie, a faithful FWWL reader, asked about saving for both Long Term and Short Term goals at the same time. Haven't we all been there? If you sit down and think of all the things you really should/want to save money for, it will probably be a mighty long list. Where do you start? Most people don't have the personal discipline to prioritize their wants and needs, so they just buy everything on credit the moment they want it and soon find themselves in deep financial trouble.

There is a better way and it works every time.

First -- Write your list. Take a couple of days or weeks to work on it, as it often takes some time for all your past ideas to come to the surface. Take this time to decide what you REALLY want and need.

Second -- Divide your list into both Long Term and Short Term financial goals.

Long Term Goals might include:

Emergency fund (3 - 6 months of take-home pay saved in cash -- this money is used to cover unexpected car repairs, household repairs, major medical expenses, and possible unemployment),

A down payment on a house,

A new car paid for with cash.

Some of these long term goals aren't that exciting, but they will bring stability and safety to your future financial life. Definitely worth the effort.

Short Term Goals might include:

A new piece of furniture,

Re-carpeting a room,

A vacation.

Remember financial goals are about both wants AND needs.

Third -- Now comes the hard part. Prioritize your Long Term Goals. 1, 2, 3. . . Same with your Short Term Goals.

You will quickly see that you cannot possibly save toward all of these at the same time, unless you have a great deal of extra money sitting around. My husband refers to this as trying to "ride your horse off in all directions at once." (He's said this to me many times over the years). If you try to spread your savings money too thinly, you will make very little progress on anything and will quickly get discouraged.

I suggest that you choose #1 from your Long Term list and #1 from your Short Term list and save for only those two. Decide how much money each of these goals needs to bring them to fruition. Then look to see how much money you can reasonably put toward each goal every month. Make yourself a chart (I LOVE CHARTS!) with completion dates. Tape the charts up somewhere you'll see them every day, so that you will keep these goals in the front of your mind. Take it from someone who has saved for dozens and dozens of things over the years -- the first few months of saving pass very, very slowly. But before you know it, it's been 6 months and your saved $ amounts begin to look pretty substantial. Those big numbers are highly motivating to keep moving forward! I've been saving up for a set of custom doors leading from my dining room to my kitchen for quite some time and just passed the $5,000 mark (these are expensive doors) and it feels GOOD. I'm ordering them soon!

The Short Term Goal will probably max out within only a few months and you can go buy whatever fabulous thing it was you wanted to get -- with cash! Celebrate not only by making your purchase, but also write across your chart in big red marker "SUCCESS!" and begin wallpapering your bathroom with these as you achieve each one OR fold up the chart and place it in your journal for future motivation. Then move onto Short Term Goal #2. You may find that some of your short term goals (possibly items #4 and below) begin to look a lot less interesting as time goes on. You'll be glad you didn't impulsively buy these items on credit and now 18 months later you're still paying for things that aren't important to you anymore. Delaying a purchase often causes your rational thinking to take control again or for you to simply change your mind. The VISA people hate that.

Your Long Term Goal may take you a few years to accomplish, but you'll get there too! It may seem like a slow process at times, but there is absolutely no other way to achieve your long term financial goals. This is where you see the value of keeping your monthly fixed expenses low. The more expensive your daily life is, the harder it is to save for your future or any extra lovely things.

By following this technique you will join that rare breed of people who save money to protect their futures and pay cash when they buy something substantial! Let me be the first to say it, "YOU are amazing!"

There is a better way and it works every time.

First -- Write your list. Take a couple of days or weeks to work on it, as it often takes some time for all your past ideas to come to the surface. Take this time to decide what you REALLY want and need.

Second -- Divide your list into both Long Term and Short Term financial goals.

Long Term Goals might include:

Emergency fund (3 - 6 months of take-home pay saved in cash -- this money is used to cover unexpected car repairs, household repairs, major medical expenses, and possible unemployment),

A down payment on a house,

A new car paid for with cash.

Some of these long term goals aren't that exciting, but they will bring stability and safety to your future financial life. Definitely worth the effort.

Short Term Goals might include:

A new piece of furniture,

Re-carpeting a room,

A vacation.

Remember financial goals are about both wants AND needs.

Third -- Now comes the hard part. Prioritize your Long Term Goals. 1, 2, 3. . . Same with your Short Term Goals.

You will quickly see that you cannot possibly save toward all of these at the same time, unless you have a great deal of extra money sitting around. My husband refers to this as trying to "ride your horse off in all directions at once." (He's said this to me many times over the years). If you try to spread your savings money too thinly, you will make very little progress on anything and will quickly get discouraged.

I suggest that you choose #1 from your Long Term list and #1 from your Short Term list and save for only those two. Decide how much money each of these goals needs to bring them to fruition. Then look to see how much money you can reasonably put toward each goal every month. Make yourself a chart (I LOVE CHARTS!) with completion dates. Tape the charts up somewhere you'll see them every day, so that you will keep these goals in the front of your mind. Take it from someone who has saved for dozens and dozens of things over the years -- the first few months of saving pass very, very slowly. But before you know it, it's been 6 months and your saved $ amounts begin to look pretty substantial. Those big numbers are highly motivating to keep moving forward! I've been saving up for a set of custom doors leading from my dining room to my kitchen for quite some time and just passed the $5,000 mark (these are expensive doors) and it feels GOOD. I'm ordering them soon!

The Short Term Goal will probably max out within only a few months and you can go buy whatever fabulous thing it was you wanted to get -- with cash! Celebrate not only by making your purchase, but also write across your chart in big red marker "SUCCESS!" and begin wallpapering your bathroom with these as you achieve each one OR fold up the chart and place it in your journal for future motivation. Then move onto Short Term Goal #2. You may find that some of your short term goals (possibly items #4 and below) begin to look a lot less interesting as time goes on. You'll be glad you didn't impulsively buy these items on credit and now 18 months later you're still paying for things that aren't important to you anymore. Delaying a purchase often causes your rational thinking to take control again or for you to simply change your mind. The VISA people hate that.

Your Long Term Goal may take you a few years to accomplish, but you'll get there too! It may seem like a slow process at times, but there is absolutely no other way to achieve your long term financial goals. This is where you see the value of keeping your monthly fixed expenses low. The more expensive your daily life is, the harder it is to save for your future or any extra lovely things.

By following this technique you will join that rare breed of people who save money to protect their futures and pay cash when they buy something substantial! Let me be the first to say it, "YOU are amazing!"

Apr 23, 2010

Monthly Expenses (Janssen)

One way we keep our overall spending down is by being very careful about adding monthly payments to our budget. In some categories, of course, you simply cannot avoid paying every single month (I think we’d mostly agree that running water isn’t really a bill we’re willing to forgo). But in general, I try to avoid committing to paying a bill every single month unless I really have to.

When you have a lot of bills you are required to pay every single month, the income you have at your disposal to pay down debts, build up savings, or fund vacations diminishes.

Worse, I’ve found that once you begin paying something every single month, you start to feel that it’s an absolute necessity, something you could never cut from your life. For me, at this point, it’s almost inconceivable to imagine not having high-speed internet at home or a cell phone.

A few years ago, Bart really wanted to get a smartphone. But not only was the cost for the phone more than I wanted to spend (I have always gone with the free phone because, really, I’m not doing anything more than making a few phone calls and sending some text messages), the cost of the plan would have increased our current cell phone bill three fold. This . . . did not really appeal to me. We finally agreed to stick with our cheap plans and free phones, and in the last two and a half years, I’ve been grateful every month for our relatively low bill.

Netflix is the same way for me – I just don’t want to be committed to paying every single month for it. I don’t want to own so many things that I need a storage unit (and its accompanying monthly fee) to hold it all.

By keeping monthly financial commitments to a minimum, we can better control our spending and increase our ability to save money and pay off our student loans at an accelerated rate. Because I don’t want to have a monthly bill for those loans either.

When you have a lot of bills you are required to pay every single month, the income you have at your disposal to pay down debts, build up savings, or fund vacations diminishes.

Worse, I’ve found that once you begin paying something every single month, you start to feel that it’s an absolute necessity, something you could never cut from your life. For me, at this point, it’s almost inconceivable to imagine not having high-speed internet at home or a cell phone.

A few years ago, Bart really wanted to get a smartphone. But not only was the cost for the phone more than I wanted to spend (I have always gone with the free phone because, really, I’m not doing anything more than making a few phone calls and sending some text messages), the cost of the plan would have increased our current cell phone bill three fold. This . . . did not really appeal to me. We finally agreed to stick with our cheap plans and free phones, and in the last two and a half years, I’ve been grateful every month for our relatively low bill.

Netflix is the same way for me – I just don’t want to be committed to paying every single month for it. I don’t want to own so many things that I need a storage unit (and its accompanying monthly fee) to hold it all.

By keeping monthly financial commitments to a minimum, we can better control our spending and increase our ability to save money and pay off our student loans at an accelerated rate. Because I don’t want to have a monthly bill for those loans either.

Apr 21, 2010

A Frugal New Member of the Family (Merrick)

My frugal life has slowed down a bit with the arrival last week of our sweet little boy! I'll be back soon with more tips and ideas to help you save money.

He's opening up a whole new world in which to save money!

Isn't he handsome??

He's opening up a whole new world in which to save money!

Isn't he handsome??

Apr 20, 2010

Second-hand Savings (Janssen)

I used to be somewhat opposed to buying secondhand items. The whole idea of using someone else’s stuff just struck me as a little bit gross.

Now the idea of paying full-price for something I can get for a fraction of the cost is pretty repellant to me.

Of course, there are some things I would still not really want to buy used (a mattress, for instance, is on my list), but many items don’t bother me at all to buy used.

When we bought our house in Texas, we needed a washer and dryer. If you’ve been to Home Depot or Sears lately, you know how outrageously expensive these can be (and they don’t even come with a maid to actually do the laundry), but when we looked on CraigsList, there were dozens and dozens of low-priced sets. We ended up purchasing one for $180; the seller told us he was basically selling the two-year-old dryer for $180 and throwing the (somewhat older) washer in for free. He’d bought the dryer for his daughter when she moved out, but she’d gotten married and her new house already had a washer and dryer. So, we were the happy beneficiaries. Both the washer and dryer worked perfectly for the three years we lived in our house and then we sold them to the buyer when we moved.

I think buying second-hand is especially useful for buying high-ticket items that other people have paid a premium for and then realized they never use. Treadmills, for example, or jogging strollers often can be bought for far below the price of a new item. My mom, who is an accomplished sewer, has mentioned how many top-of-the-line sewing machines are available for much less than a new one could be purchased for – no doubt bought by someone who thought a $2500 sewing machine would suddenly turn them into a sewing wizard.

What things are you willing to buy second-hand?

Now the idea of paying full-price for something I can get for a fraction of the cost is pretty repellant to me.

Of course, there are some things I would still not really want to buy used (a mattress, for instance, is on my list), but many items don’t bother me at all to buy used.

When we bought our house in Texas, we needed a washer and dryer. If you’ve been to Home Depot or Sears lately, you know how outrageously expensive these can be (and they don’t even come with a maid to actually do the laundry), but when we looked on CraigsList, there were dozens and dozens of low-priced sets. We ended up purchasing one for $180; the seller told us he was basically selling the two-year-old dryer for $180 and throwing the (somewhat older) washer in for free. He’d bought the dryer for his daughter when she moved out, but she’d gotten married and her new house already had a washer and dryer. So, we were the happy beneficiaries. Both the washer and dryer worked perfectly for the three years we lived in our house and then we sold them to the buyer when we moved.

I think buying second-hand is especially useful for buying high-ticket items that other people have paid a premium for and then realized they never use. Treadmills, for example, or jogging strollers often can be bought for far below the price of a new item. My mom, who is an accomplished sewer, has mentioned how many top-of-the-line sewing machines are available for much less than a new one could be purchased for – no doubt bought by someone who thought a $2500 sewing machine would suddenly turn them into a sewing wizard.

What things are you willing to buy second-hand?

Apr 16, 2010

Pick Up the Phone (Janssen)

I do not particularly like to talk on the phone; I almost always request that my husband make the phone calls to arrange social events and, aside from my mom and my sisters, I rarely rarely call "just to chat."

But when it comes to calling in order to save myself some money (or to get back money that belongs to me), I am on the phone in a heartbeat. I think lots of people just don't want to make the effort to make a call and complain or make a request, but since the payoff is usually quite high, I am completely willing to put aside my discomfort on the phone and spent five or ten minutes keeping my money in my wallet.

I've waived bank fees, had late fees refunded, rebooked hotel rooms when the price dropped, asked companies to meet competitor prices, and had automatic payments refunded when I'd forgotten to cancel them. None of these have ever taken very long and it has saved us, I'd estimate, at least $1000 over the last five years.

Are you willing to make those calls?

But when it comes to calling in order to save myself some money (or to get back money that belongs to me), I am on the phone in a heartbeat. I think lots of people just don't want to make the effort to make a call and complain or make a request, but since the payoff is usually quite high, I am completely willing to put aside my discomfort on the phone and spent five or ten minutes keeping my money in my wallet.

I've waived bank fees, had late fees refunded, rebooked hotel rooms when the price dropped, asked companies to meet competitor prices, and had automatic payments refunded when I'd forgotten to cancel them. None of these have ever taken very long and it has saved us, I'd estimate, at least $1000 over the last five years.

Are you willing to make those calls?

Apr 15, 2010

Re-thinking the Cabin (Carole)

I didn't grow up in an environment where people had second homes. But when I moved to the mid-west I found that many people (even people with the most modest of means, it seemed) had a lake house. This was astonishing to me.

But like any red-blooded American woman I began to think, "Wouldn't that be GREAT to have a lake house??" Or a mountain cabin, or a beach house or a vacation home or whatever this kind of 2nd home is called in your area. Something I'd never considered before in my life, suddenly became something I really wanted in my future. It just sounded so relaxing. . .

Luckily I have a wise mother-in-law. She mentioned to me about 20 years ago that she didn't understand the whole 2nd home idea. I was shocked. I knew she had many, many friends who had cabins and lake houses. How could she think this?? Then she told me why she wasn't interested:

1. You feel obligated to go to the same place -- EVERY YEAR. She wanted the freedom to go somewhere new when she had the inclination to get away -- anywhere in the world.

2. You have to clean it every time you go and again when you leave. On the other hand, every vacation destination pays people to not only clean things up when you leave, but they keep it clean every day that you're their guest.

3. You are always concerned about vandalism (when you're away) and seasonal maintenance. At your vacation destination, you have none of these concerns. You waltz in and you waltz out.

4. Your down payment ALONE on the property (say $20,000) could buy you 50 nights at a hotel charging $400/night. That's one terrific vacation room! If your room was only $200/night you'd be able to vacation for 100 days! And this money doesn't even count your $1000 mortgage payment (and home owners insurance) every month for 15 or 30 years.

I'm not too quick sometimes, but I began to see that her reasons made a whole lot of sense. I've joined her No Vacation House Club. Maybe you see a 2nd home as an investment. That's great. But I'd personally rather have an investment that didn't require me to clean toilets and kill mice.

To borrow (and alter) my college's motto: The World is My Vacation House.

But like any red-blooded American woman I began to think, "Wouldn't that be GREAT to have a lake house??" Or a mountain cabin, or a beach house or a vacation home or whatever this kind of 2nd home is called in your area. Something I'd never considered before in my life, suddenly became something I really wanted in my future. It just sounded so relaxing. . .

Luckily I have a wise mother-in-law. She mentioned to me about 20 years ago that she didn't understand the whole 2nd home idea. I was shocked. I knew she had many, many friends who had cabins and lake houses. How could she think this?? Then she told me why she wasn't interested:

1. You feel obligated to go to the same place -- EVERY YEAR. She wanted the freedom to go somewhere new when she had the inclination to get away -- anywhere in the world.

2. You have to clean it every time you go and again when you leave. On the other hand, every vacation destination pays people to not only clean things up when you leave, but they keep it clean every day that you're their guest.

3. You are always concerned about vandalism (when you're away) and seasonal maintenance. At your vacation destination, you have none of these concerns. You waltz in and you waltz out.

4. Your down payment ALONE on the property (say $20,000) could buy you 50 nights at a hotel charging $400/night. That's one terrific vacation room! If your room was only $200/night you'd be able to vacation for 100 days! And this money doesn't even count your $1000 mortgage payment (and home owners insurance) every month for 15 or 30 years.

I'm not too quick sometimes, but I began to see that her reasons made a whole lot of sense. I've joined her No Vacation House Club. Maybe you see a 2nd home as an investment. That's great. But I'd personally rather have an investment that didn't require me to clean toilets and kill mice.

To borrow (and alter) my college's motto: The World is My Vacation House.

Labels:

Housing,

Investing,

Travel,

Unnecessary Expenses

Apr 13, 2010

Simple Budgeting Plan (Carole)

I like to read books about money. You too? Right now I'm reading a brand new book called Your Money: The Missing Manual by J. D. Roth. I've just recently discovered Mr. Roth, but it turns out he is a long-time blogger at Get Rich Slowly. Check it out. You'll find he has tons of good ideas and stories.

However, back to the budgeting plan. . . in J.D. Roth's very readable book he tells of a very simple budgeting plan proposed in another book, All Your Worth by Elizabeth Warren and Amelia Tyagi (I haven't read All Your Worth yet -- but I plan to). These two authors recommend dividing your take-home money into 3 simple categories.

1. 50% of your money for needs: housing, food, transportation, insurance, basic wardrobe. . . (this is where some hacking and slashing may be needed -- a very worthy endeavor)

2. 30% of your money for wants: eating out, extra clothes, books, cable TV, hobbies, travel. . .

3. 20% of your money for savings (this should be used for paying off debt if that is where you are on your financial journey)

(For those of us who pay a tithe to our church, I would suggest dividing your money into these 3 percentage categories AFTER you've paid tithing -- otherwise you'll get all goofed up.)

This balanced plan (as they describe it) lets you have fun (30% of your take-home pay is A LOT of fun!) while living within your means AND paying off debt or saving for your future. If you've struggled to live on a budget, give this really good method a try. Let me know if it helps!

However, back to the budgeting plan. . . in J.D. Roth's very readable book he tells of a very simple budgeting plan proposed in another book, All Your Worth by Elizabeth Warren and Amelia Tyagi (I haven't read All Your Worth yet -- but I plan to). These two authors recommend dividing your take-home money into 3 simple categories.

1. 50% of your money for needs: housing, food, transportation, insurance, basic wardrobe. . . (this is where some hacking and slashing may be needed -- a very worthy endeavor)

2. 30% of your money for wants: eating out, extra clothes, books, cable TV, hobbies, travel. . .

3. 20% of your money for savings (this should be used for paying off debt if that is where you are on your financial journey)

(For those of us who pay a tithe to our church, I would suggest dividing your money into these 3 percentage categories AFTER you've paid tithing -- otherwise you'll get all goofed up.)

This balanced plan (as they describe it) lets you have fun (30% of your take-home pay is A LOT of fun!) while living within your means AND paying off debt or saving for your future. If you've struggled to live on a budget, give this really good method a try. Let me know if it helps!

Apr 12, 2010

Naming Your Accounts (Janssen)

Dave Ramsey likes to say, when talking about budgeting, "Tell your money where to go." We try to make this happen in our family budget, but sometimes it's difficult when money is being saved up for various future expenditures (say, a twice-yearly bill or a vacation or a large purchase) instead of being spent by the end of the month.

To combat this slushfund approach, where your money being saved for various expenses is all mixing together, untitled, in your checking account, Bart and I have a whole host of savings accounts. We use ING Direct and it's incredibly easy (and free) to open as many savings accounts as you'd like. You can name them whatever you choose and there is no fee to transfer money between various accounts.

For instance, we currently have an account called "Student Loans." When we get extra money or deposit a check, we put that money directly into the Student Loan fund, where it sits for a week or two until our next paycheck and then we pay the total amount toward our student loans. There's no temptation to accidentally spend the $85 check we'd said was for the student loans, because it's not in our checking account.

Likewise, our fifth anniversary is coming up this summer, and we wanted to do something great. About a year ago, we opened an account called "5th Anniversary" and started putting money towards it. All our graduation gift money went into that account and when plane tickets went on sale earlier this year, the money was right there ready to be spend (and to help us determine how much we could afford). The money hadn't been washed away in electric bills or fast food or an impulse pair of shoes.

Putting a name on our money, having it in a dedicated, specific location, makes budgeting and saving considerably easier for us.

Any one else use multiple accounts this way?

To combat this slushfund approach, where your money being saved for various expenses is all mixing together, untitled, in your checking account, Bart and I have a whole host of savings accounts. We use ING Direct and it's incredibly easy (and free) to open as many savings accounts as you'd like. You can name them whatever you choose and there is no fee to transfer money between various accounts.

For instance, we currently have an account called "Student Loans." When we get extra money or deposit a check, we put that money directly into the Student Loan fund, where it sits for a week or two until our next paycheck and then we pay the total amount toward our student loans. There's no temptation to accidentally spend the $85 check we'd said was for the student loans, because it's not in our checking account.

Likewise, our fifth anniversary is coming up this summer, and we wanted to do something great. About a year ago, we opened an account called "5th Anniversary" and started putting money towards it. All our graduation gift money went into that account and when plane tickets went on sale earlier this year, the money was right there ready to be spend (and to help us determine how much we could afford). The money hadn't been washed away in electric bills or fast food or an impulse pair of shoes.

Putting a name on our money, having it in a dedicated, specific location, makes budgeting and saving considerably easier for us.

Any one else use multiple accounts this way?

Apr 9, 2010

Teaching Your Children About Money #1 (Carole)

When I was in college, I took an education class from a professor who always had a hands-on method of getting his point across. One of the many great lessons he shared with us was a powerful way to help your children understand the value of money and how it works within your own family.

He suggested that one month, instead of depositing your paycheck in your account, you cash the whole thing into $20 bills. (You may need to hire yourself some security for the evening. . .) Bring all that cash home and stack it on the living room floor. Sit your kids down on the carpet (enjoy watching their eyes bug out) and explain that this is ALL the money your family has to buy things with during the coming month. They will be very impressed with your piles of cash at this point!

Then bring out a poster with the monthly family expenses listed in a large font. Have them count out the bills to "pay" the bills -- mortgage, grocery bill, electricity, water, sewer, insurance, gasoline, car insurance, piano lessons, etc. They will watch those stacks of green backs disappear just like you do every month. When you've paid all the bills, let them count up how much money is left. This just might be the most sobering moment of their young lives, and will help them understand why the $80 tennis shoes or $150 jeans they want might not be in the best interest of the entire family.

If you are uncomfortable using real money, try using Monopoly money or cutting up green paper and writing $20 on each one. But, as you can imagine, it would be much more effective using the real thing.

I

He suggested that one month, instead of depositing your paycheck in your account, you cash the whole thing into $20 bills. (You may need to hire yourself some security for the evening. . .) Bring all that cash home and stack it on the living room floor. Sit your kids down on the carpet (enjoy watching their eyes bug out) and explain that this is ALL the money your family has to buy things with during the coming month. They will be very impressed with your piles of cash at this point!

Then bring out a poster with the monthly family expenses listed in a large font. Have them count out the bills to "pay" the bills -- mortgage, grocery bill, electricity, water, sewer, insurance, gasoline, car insurance, piano lessons, etc. They will watch those stacks of green backs disappear just like you do every month. When you've paid all the bills, let them count up how much money is left. This just might be the most sobering moment of their young lives, and will help them understand why the $80 tennis shoes or $150 jeans they want might not be in the best interest of the entire family.

If you are uncomfortable using real money, try using Monopoly money or cutting up green paper and writing $20 on each one. But, as you can imagine, it would be much more effective using the real thing.

I

Apr 8, 2010

Keep The Change (Merrick)

When I met Philip, he had a big plastic jar that he kept all his change in. He estimated that the change in the money jar equaled about $50. I have never been much of a change keeper, but after we got married I converted and added my $3 (or something pathetically low) worth of coins to the jar, we upgraded to a larger plastic bin, and from then on we started keeping all our change. Since Philip works for a car rental company, he frequently washes cars where he runs across coins that people have left behind. This change goes in the change bin along with any other loose change we find in the house, in the car, or in my purse.

Now that we’ve been married three and a half years, this plastic bin is filled with change – and not just pennies. We’re estimating several hundred dollars of change.

Over the last few months we’ve been talking about buying a nice kitchen table to replace our tiny and cheap IKEA table. I suggested that we use this change. It may not cover the entire cost of a table and six chairs, but it will probably cover most of it. It is amazing to me that a quarter here and a nickel there, accumulated over a few years, will be able to make such a huge purchase. We rarely think about this money, and have never missed it, so it’s almost like having a huge chunk of free money to spend on something we would really like to buy!

I’ve heard of others using their spare change to save for family vacations. Others, to buy cleaning supplies and other household necessities. Some use it up every month, and others save it for years. But any way that you look at it, it’s basically free money that allows you to make purchases that won’t take away from that month’s paycheck. And really, you can’t get much better than that.

So readers, do you save your change? And if so, what do you use it for?

Apr 7, 2010

Homemade (Janssen)

If you're willing to eat the very cheapest bread available at the store (the store-brand of Wonder Bread, likely), it's probably least expensive to buy bread. If the idea of having your bread adhere to the roof of your mouth makes you a bit ill, however (like me!), you may be able to save money by making your own bread.

The bread I buy at the grocery store (whole wheat, minimal extra filler ingredients) costs, on sale, about $2.50 - $3.00 per loaf. After a while, this started to seem like a place I could save some money, have some healthier bread, and make my homemade-bread loving husband happier.

This is the recipe I use, which I calculate costs me about $0.70 per loaf (not counting the energy it costs to run the oven). I also think it might be a bit cheaper for you depending on where you live, since I know flour and sugar were cheaper in Texas than they are for me now in Boston.

I've also updated the recipe to use instant yeast, which I really like because it shaves a good hour off your time since you don't need to proof the yeast or let it rise before you shape it.

Whole Wheat Bread (recipe adapted from Mel's Kitchen Cafe)

(2 loaves)

2 3/4 cups warm water (for all intents and purposes, free)

1/4 cup sugar ($0.05)

1/4 cup oil ($0.06)

1 tablespoon instant yeast ($0.04)

1 tablespoon salt ($0.01)

1 tablespoon vital wheat gluten ($0.08)

1 tablespoon nonfat dry milk ($0.10)

1 cup white flour ($0.17)

4-5 cups white wheat flour ($0.89)

Combine yeast sugar, oil, salt, gluten and dry milk together in the bowl and mix with an electric mixer or by hand. Add white flour and mix well. Continue adding the whole wheat flour until the dough cleans the sides of the bowl and the dough is soft but not overly sticky. Knead for 10 minutes until a soft, smooth dough has formed.

Form into 2 loaves. Place the loaves into lightly greased bread pans and cover. Let them rise until the dough has risen about 1 1/2 inches above the top of the bread pan.

Place the bread pans in cold oven. Turn the oven on to 350 degrees and bake for 38 minutes.

Remove from the oven and turn out the bread onto a wire rack. Let cool completely before slicing.

I slice up my entire loaves, put them in bread bags (which I've saved from my store-bought bread), and stick them in the freezer. Easy and delicious.

The bread I buy at the grocery store (whole wheat, minimal extra filler ingredients) costs, on sale, about $2.50 - $3.00 per loaf. After a while, this started to seem like a place I could save some money, have some healthier bread, and make my homemade-bread loving husband happier.

This is the recipe I use, which I calculate costs me about $0.70 per loaf (not counting the energy it costs to run the oven). I also think it might be a bit cheaper for you depending on where you live, since I know flour and sugar were cheaper in Texas than they are for me now in Boston.

I've also updated the recipe to use instant yeast, which I really like because it shaves a good hour off your time since you don't need to proof the yeast or let it rise before you shape it.

Whole Wheat Bread (recipe adapted from Mel's Kitchen Cafe)

(2 loaves)

2 3/4 cups warm water (for all intents and purposes, free)

1/4 cup sugar ($0.05)

1/4 cup oil ($0.06)

1 tablespoon instant yeast ($0.04)

1 tablespoon salt ($0.01)

1 tablespoon vital wheat gluten ($0.08)

1 tablespoon nonfat dry milk ($0.10)

1 cup white flour ($0.17)

4-5 cups white wheat flour ($0.89)

Combine yeast sugar, oil, salt, gluten and dry milk together in the bowl and mix with an electric mixer or by hand. Add white flour and mix well. Continue adding the whole wheat flour until the dough cleans the sides of the bowl and the dough is soft but not overly sticky. Knead for 10 minutes until a soft, smooth dough has formed.

Form into 2 loaves. Place the loaves into lightly greased bread pans and cover. Let them rise until the dough has risen about 1 1/2 inches above the top of the bread pan.

Place the bread pans in cold oven. Turn the oven on to 350 degrees and bake for 38 minutes.

Remove from the oven and turn out the bread onto a wire rack. Let cool completely before slicing.

I slice up my entire loaves, put them in bread bags (which I've saved from my store-bought bread), and stick them in the freezer. Easy and delicious.

Apr 6, 2010

Paying for Your Children's College (Carole)

Every once in awhile, you come across a great family with a great idea and it changes your life. I mentioned in my last post, that we had a couple of friends who had paid off their homes back when we were all in our early 30's. These folks really inspired us and we were able to follow their lead. Well, there was another family that we met back in those same years who had children who were about 6 - 8 years older than ours that completely changed our thinking on paying for our children's college educations.

This family had 6 children. They were not wealthy by any means, but every one of their children received a bachelor's degree, without taking out student loans. The basic concepts were:

1. Children are expected to attend a university or community college that has a reasonable yearly tuition (meaning, your student can earn enough money during a summer to completely pay for the following year's tuition)

2. Children are expected to pay their own tuition and books for the full four years

3. Parents will pay for room and board (either dorm or off-campus housing) through all four years of school

This wonderful family did not broadcast this plan, but as we interacted with the parents and their children over a 10 year period of time, it became obvious that this was what they were doing. And it WORKED.

And so did those kids. :) From the time they were 15 or 16, these kids had jobs. They babysat, worked at local businesses, and even had their own family-run summer business. Most of this money was saved for their future college educations. When these kids left for college as freshmen, they had considerable amounts of money in their bank accounts, which meant that even before they moved into the dorms, they had earned some serious financial experience and education. It was amazing to chat with these young college students when they came home for a visit, because they knew EXACTLY how much each college credit was costing them and they knew how much they needed to save each summer to pay for the next year's tuition (to replenish their savings accounts and keep a comfortable money buffer a.k.a. Emergency Fund). In addition, they were highly motivated to get and keep scholarships since this could save them a whole ton of money each semester. And lastly, they kept on track. They didn't want to spend one more semester than was necessary to get that college diploma!

Talk about teaching your children some life skills!! Like I said, each of them are college graduates -- and at least a couple have graduate degrees.

College should be a FIRST STEP into adulthood for your children -- Controlled Freedom is what I like to call it. To have parents pay for everything (tuition and room and board), in my opinion, delays your children learning some valuable financial lessons of adult life and prolongs the free-ride high school mentality -- hardly preparing your children for real life after college. On the other hand, to expect your children to get a college education with no financial help (or very little) from you the parent, is just asking for them to drop out or take on oppressive student loans. This is too much financial responsibility to ask of a teenager who has just left high school. And, I personally think it is a bad idea to accrue student loans for just a bachelor's degree. Graduate degrees, however, are a different financial animal.

We followed this simple program with our children. Both Janssen and Merrick received their bachelor's degrees this way (I must mention here that when J and M each got married while still in undergraduate school, we no longer paid for their housing or food -- I'm very proud of them and their exceptional husbands that they still finished their degrees without any debt, completely independent of our financial help) and daughter #3 is a senior in college (unmarried) following the same plan. Child #4 knows already, at age 14, that this is what's ahead. He's already saving money!

What a relief to us as parents to not have to save $60,000+ for each child's college education. This simple plan allowed us to have a solid strategy for our children's educational futures, but to also take care of the other important family financial needs as they were growing up -- like paying off the house, saving for retirement and many great family vacations.

What a blessing to have inspiring and really smart friends to show you the way!

This family had 6 children. They were not wealthy by any means, but every one of their children received a bachelor's degree, without taking out student loans. The basic concepts were:

1. Children are expected to attend a university or community college that has a reasonable yearly tuition (meaning, your student can earn enough money during a summer to completely pay for the following year's tuition)

2. Children are expected to pay their own tuition and books for the full four years

3. Parents will pay for room and board (either dorm or off-campus housing) through all four years of school

This wonderful family did not broadcast this plan, but as we interacted with the parents and their children over a 10 year period of time, it became obvious that this was what they were doing. And it WORKED.

And so did those kids. :) From the time they were 15 or 16, these kids had jobs. They babysat, worked at local businesses, and even had their own family-run summer business. Most of this money was saved for their future college educations. When these kids left for college as freshmen, they had considerable amounts of money in their bank accounts, which meant that even before they moved into the dorms, they had earned some serious financial experience and education. It was amazing to chat with these young college students when they came home for a visit, because they knew EXACTLY how much each college credit was costing them and they knew how much they needed to save each summer to pay for the next year's tuition (to replenish their savings accounts and keep a comfortable money buffer a.k.a. Emergency Fund). In addition, they were highly motivated to get and keep scholarships since this could save them a whole ton of money each semester. And lastly, they kept on track. They didn't want to spend one more semester than was necessary to get that college diploma!

Talk about teaching your children some life skills!! Like I said, each of them are college graduates -- and at least a couple have graduate degrees.

College should be a FIRST STEP into adulthood for your children -- Controlled Freedom is what I like to call it. To have parents pay for everything (tuition and room and board), in my opinion, delays your children learning some valuable financial lessons of adult life and prolongs the free-ride high school mentality -- hardly preparing your children for real life after college. On the other hand, to expect your children to get a college education with no financial help (or very little) from you the parent, is just asking for them to drop out or take on oppressive student loans. This is too much financial responsibility to ask of a teenager who has just left high school. And, I personally think it is a bad idea to accrue student loans for just a bachelor's degree. Graduate degrees, however, are a different financial animal.

We followed this simple program with our children. Both Janssen and Merrick received their bachelor's degrees this way (I must mention here that when J and M each got married while still in undergraduate school, we no longer paid for their housing or food -- I'm very proud of them and their exceptional husbands that they still finished their degrees without any debt, completely independent of our financial help) and daughter #3 is a senior in college (unmarried) following the same plan. Child #4 knows already, at age 14, that this is what's ahead. He's already saving money!

What a relief to us as parents to not have to save $60,000+ for each child's college education. This simple plan allowed us to have a solid strategy for our children's educational futures, but to also take care of the other important family financial needs as they were growing up -- like paying off the house, saving for retirement and many great family vacations.

What a blessing to have inspiring and really smart friends to show you the way!

Apr 5, 2010

Skills That Save - Part 2 (Merrick)

When I was eleven or twelve, my mom signed me up for sewing lessons. My mom is a good seamstress but didn’t feel like she had the ability to teach all of us on her own. Although I wouldn’t say sewing was a great passion of mine, I enjoyed taking lessons for a few years, made many fun things for myself, liked bragging that I had made a clothing item when someone commented on it, and most of all developed a great skill that has saved me money throughout my life.

So today I want to tell you, and show you, how you can save money by learning to sew.

I think clothing is the biggest area wherein I’ve saved. Whether it’s being able to patch my husband’s dress pants when he puts a hole in them, making a few fabric flowers to spruce up a boring t-shirt, or buying a $3 extra large skirt and being able to make it my size, these are all areas I’ve been able to use my sewing skills to save money. Similarly, my mom has mentioned many times over the years that when they were on a tight budget, she was still able to update the house with new curtains or pillows, or make herself a new dress or her children new swimsuits, all because she could buy cheap fabric and knew how to sew.

Although the idea of sewing may be daunting, it’s really not as hard as you may think. Knowing how to operate your sewing machine, being able to read a pattern, and then practicing your sewing skills is really all you need to be on your way to saving money.

Here are a few good sources of inspiration to show you that it’s possible to save by sewing, and it’s not that hard:

Marisa of “New Dress A Day” buys $1 items at flea markets and garage sales, and then with a few cuts and a few seams, she turns them into adorable clothing items. Really, the level of sewing required for most of items she transforms is pretty simple – again, it’s just knowing how to use your machine and then practicing so you get better.

My Aunt Miriam recently blogged about making a dress for her daughter from an old skirt of hers. If you look at the photo in this post, it’s a simple dress that probably required very little sewing, but turned out very cute and was completely free.

Make It and Love It is another blog I look at frequently. She is all about repurposing clothing – anything from shoes, to mens shirts, to her children's clothing, and usually spends little to no money on these updates. And the best part is, she has tutorials for many of the items she makes.

Even with a basic knowledge of sewing, which is fairly easy to acquire, this skill will help you save money. By updating old clothing with cute embellishments, sewing a simple seam to make a shirt fit better, putting a patch in worn out pants, or making $10 curtains, you can and will save a ton of money in the long run.

So today I want to tell you, and show you, how you can save money by learning to sew.

I think clothing is the biggest area wherein I’ve saved. Whether it’s being able to patch my husband’s dress pants when he puts a hole in them, making a few fabric flowers to spruce up a boring t-shirt, or buying a $3 extra large skirt and being able to make it my size, these are all areas I’ve been able to use my sewing skills to save money. Similarly, my mom has mentioned many times over the years that when they were on a tight budget, she was still able to update the house with new curtains or pillows, or make herself a new dress or her children new swimsuits, all because she could buy cheap fabric and knew how to sew.

Although the idea of sewing may be daunting, it’s really not as hard as you may think. Knowing how to operate your sewing machine, being able to read a pattern, and then practicing your sewing skills is really all you need to be on your way to saving money.

Here are a few good sources of inspiration to show you that it’s possible to save by sewing, and it’s not that hard:

Marisa of “New Dress A Day” buys $1 items at flea markets and garage sales, and then with a few cuts and a few seams, she turns them into adorable clothing items. Really, the level of sewing required for most of items she transforms is pretty simple – again, it’s just knowing how to use your machine and then practicing so you get better.

My Aunt Miriam recently blogged about making a dress for her daughter from an old skirt of hers. If you look at the photo in this post, it’s a simple dress that probably required very little sewing, but turned out very cute and was completely free.

Make It and Love It is another blog I look at frequently. She is all about repurposing clothing – anything from shoes, to mens shirts, to her children's clothing, and usually spends little to no money on these updates. And the best part is, she has tutorials for many of the items she makes.

Even with a basic knowledge of sewing, which is fairly easy to acquire, this skill will help you save money. By updating old clothing with cute embellishments, sewing a simple seam to make a shirt fit better, putting a patch in worn out pants, or making $10 curtains, you can and will save a ton of money in the long run.

Apr 2, 2010

A Peek at the Promised Land (Carole)

A few weeks ago, Tara commented that she didn't see the point in being frugal, frugal, frugal just so she could be a millionaire when she and her husband are 80! What is the fun in that?? Maybe some of you have had the same thoughts as you've thought about coupon-ing, garage sale-ing, eating at home. . . Hopefully, I can give you a glimpse at where this whole Frugal Life thing is really headed.

If you have credit card debt, car loans and/or student loans, most people (when you finally get very serious about it) can pay all of it off within 3 years. We have never carried credit card debt, but we've had a few car loans and we had over $60,000 in student loans back in the 1980's -- so about $130,000 in today's money. We paid minimum payments for a number of years, and then we got religion. We paid off our car in about 8 months and our student loans in about 2 years. So we paid off all our consumer debt in right around that 3 year mark. We weren't making tons of money and we had 3 children. We were extremely average. You could probably pay things off faster than we did.

Our next step was paying off our house. We knew a couple of families our own age (early 30's) who had paid off their houses. We were AMAZED. Could we do that too?? How long would something like that take? We owed about $160,000 on our house at the time. As a little family we confronted this monumental financial goal with everything we had. We printed out an amortization schedule (numerous pages of small type -- very scary), and taped it ALL to the back of the door where the bills were paid in our house. Every month when we paid our regular house payment, we also added as much extra $$ as we could scrape out of our home budget and sent that along to the mortgage company too -- that extra money goes straight to the principle. We often gathered our 3 girls into the room while we marked off the payment amount with a highlighter pen and circled all the skipped interest payments that NEVER HAS TO BE PAID-- EVER!! Did we starve through this time? Live on nothing? Never leave the house? No, we actually took a few pretty decent vacations along the way and fed and clothed everyone. Probably saw a few movies too. But we stuck to our house payback schedule. We threw everything we could at this debt and in 3+ years we received our title, free and clear, in the mail. That is a moment never to be forgotten.

We paid that house off in 1996. In 2003 I wanted a bigger house (we had more children, the older ones were larger, and we wanted to live in a better school district). We found the house we wanted and went back into a $100,000 mortgage (we were able to pay for MOST of the house with cold, hard cash from the sale of our first house -- that felt very, very nice). We paid off this new mortgage in about 2 years. I thought I would mention here that both times we got down to the last $30,000 on our mortgage, extra money just started appearing. I can't even explain it. It's like the Lord knows you are serious about taking care of your family and your finances, so He blesses you beyond anything you've ever seen. The last $30,000 was paid off about 5 months earlier than scheduled -- both times. When you get to that point, let me know if this happens to you too!

So, when you've paid off all of your debt -- in under 5 years probably -- how does life look? It is an amazing place to be. Think of the amount of money you bring home every month in your paycheck. Now think of how much it would cost you to live with no major bills. No credit card payments, no car loans, no student loans, no house payment. Can you even wrap your mind around that?

You still have to buy food, electricity, gasoline, car insurance, clothes, property taxes. That's about it. Hmm. How much would that add up to in a month? Not very much. All the rest of your take home pay is YOURS. Wow.

What will you do with it?

Saving is a big thing. Putting as much money as you can into tax-free or tax-deferred programs is very smart.

Beyond that, you can spend it on anything you want. You could buy a new car with cash -- every few months! You could buy a brand new boat in cash, also in just a few months. You could redecorate your entire house. Put in a backyard pool. You can be generous beyond anything you can imagine. Travel to Europe, Asia, Africa -- every few months. All for cash.

You will finally be free. All the hard work you (or your spouse) puts in to bring home money, will finally benefit YOU. All in about 5 years.

Enjoy.

If you have credit card debt, car loans and/or student loans, most people (when you finally get very serious about it) can pay all of it off within 3 years. We have never carried credit card debt, but we've had a few car loans and we had over $60,000 in student loans back in the 1980's -- so about $130,000 in today's money. We paid minimum payments for a number of years, and then we got religion. We paid off our car in about 8 months and our student loans in about 2 years. So we paid off all our consumer debt in right around that 3 year mark. We weren't making tons of money and we had 3 children. We were extremely average. You could probably pay things off faster than we did.

Our next step was paying off our house. We knew a couple of families our own age (early 30's) who had paid off their houses. We were AMAZED. Could we do that too?? How long would something like that take? We owed about $160,000 on our house at the time. As a little family we confronted this monumental financial goal with everything we had. We printed out an amortization schedule (numerous pages of small type -- very scary), and taped it ALL to the back of the door where the bills were paid in our house. Every month when we paid our regular house payment, we also added as much extra $$ as we could scrape out of our home budget and sent that along to the mortgage company too -- that extra money goes straight to the principle. We often gathered our 3 girls into the room while we marked off the payment amount with a highlighter pen and circled all the skipped interest payments that NEVER HAS TO BE PAID-- EVER!! Did we starve through this time? Live on nothing? Never leave the house? No, we actually took a few pretty decent vacations along the way and fed and clothed everyone. Probably saw a few movies too. But we stuck to our house payback schedule. We threw everything we could at this debt and in 3+ years we received our title, free and clear, in the mail. That is a moment never to be forgotten.

We paid that house off in 1996. In 2003 I wanted a bigger house (we had more children, the older ones were larger, and we wanted to live in a better school district). We found the house we wanted and went back into a $100,000 mortgage (we were able to pay for MOST of the house with cold, hard cash from the sale of our first house -- that felt very, very nice). We paid off this new mortgage in about 2 years. I thought I would mention here that both times we got down to the last $30,000 on our mortgage, extra money just started appearing. I can't even explain it. It's like the Lord knows you are serious about taking care of your family and your finances, so He blesses you beyond anything you've ever seen. The last $30,000 was paid off about 5 months earlier than scheduled -- both times. When you get to that point, let me know if this happens to you too!

So, when you've paid off all of your debt -- in under 5 years probably -- how does life look? It is an amazing place to be. Think of the amount of money you bring home every month in your paycheck. Now think of how much it would cost you to live with no major bills. No credit card payments, no car loans, no student loans, no house payment. Can you even wrap your mind around that?

You still have to buy food, electricity, gasoline, car insurance, clothes, property taxes. That's about it. Hmm. How much would that add up to in a month? Not very much. All the rest of your take home pay is YOURS. Wow.

What will you do with it?

Saving is a big thing. Putting as much money as you can into tax-free or tax-deferred programs is very smart.

Beyond that, you can spend it on anything you want. You could buy a new car with cash -- every few months! You could buy a brand new boat in cash, also in just a few months. You could redecorate your entire house. Put in a backyard pool. You can be generous beyond anything you can imagine. Travel to Europe, Asia, Africa -- every few months. All for cash.

You will finally be free. All the hard work you (or your spouse) puts in to bring home money, will finally benefit YOU. All in about 5 years.

Enjoy.